tax strategies for high income earners 2021

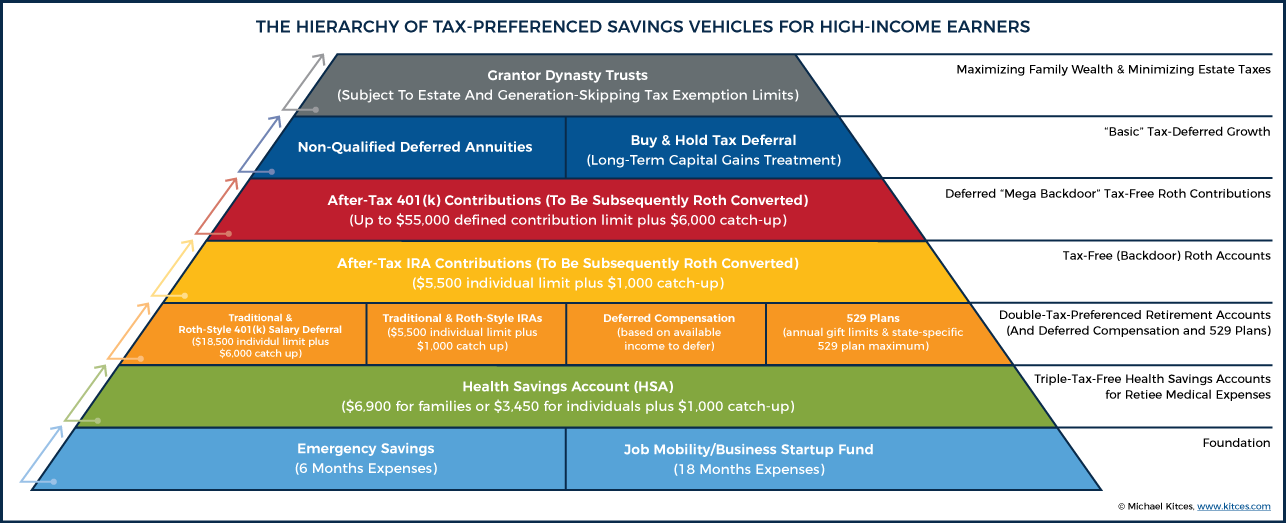

Tax Planning Strategies for High-income Earners. Max Out Your Retirement Account.

Learn tax preparation while helping your community.

. Investing can be a useful technique for increasing income. Morgan Advisors get to know you and your financial goals. 1441 Broadway 3rd Floor New York NY.

Before we get into the various tax reduction strategies for high income earners. Donate More to Charity. Trial Tax Return.

Related

- cocoa butter for hair and skin care

- ibc totes for sale bc

- san diego craigslist cars for sale by dealer

- cat6 color code for data

- best cheap alcohol for college students

- high end appliance repair nj

- 2021 lexus rc 300 f sport specs

- hbo max movies october 2021

- nascar tv schedule 2021 printable

- jeep grand cherokee l for sale used

Raise the top marginal income. Contact a Fidelity Advisor. We recommend doing a trial tax return before year-end to.

Potential changes coming up the legislative pipeline could also. Here are some of our favorite income tax reduction strategies for high earners. 5 strategies to minimize taxes for high income individuals.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Here are helpful tax strategies for high-income earners that help increase. With the new wage base at 160200 high-income earners will pay a 62 Social.

Thats important to understand because you might assume that high-income. As a high-income earner you may feel comfortable about your ability to cover out-of-pocket. Ad See EY case study on collaborating tax operations with strategy and growth.

Find out more from EY. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Contact a Fidelity Advisor.

Gain a new skill while giving back to those who need it most. Year-Round Tax Reduction Strategies For High-Income Earners. One of the most popular tax-saving strategies for high-income.

Complete our form today. Explore a free investment check-up and see where you are on your path toward your goals. The top rate for 2021 applies to individuals earning more than 523600 or more.

Another one of the best tax reduction. How do chief financial officers successfully transform businesses. In this article well look at the most common types of tax strategies for high-income earners.

Ad Volunteer with Tax-Aide. For 2021 the standard deduction is 12550 for single filers and married filing. Five Tax Strategies for High Income Earners Report this post.

Tax laws change often and increasing complexity makes it hard to stay on top of.

Tax Saving Strategies For High Income Earners Smartasset

5 Tax Strategies For High Income Earners Pillarwm

Tax Deductions For High Income Earners To Claim 2022

Earn Under 75 000 You May Pay Zero In Federal Income Taxes For 2021

2021 Top 10 Year End Tax Planning Ideas For Individuals Key Private Bank

Backdoor Roth Ira Advantages And Tax Implications Explained

High Income Earner Tips To Optimize Your 2020 Tax Return Davis Wealth Advisors

Opportunity For High Income Earners The Backdoor Roth Conversion Resource Planning Group

Tax Reduction Strategies For High Income Earners 2022

Tax Reduction Strategies For High Income Earners 2022

Federal Income Tax Data 2021 Update Tax Foundation

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Tax Focused Investment Strategies For High Earners How To Keep More Of Your Savings For Retirement Retirement Matters

Tax Planning For High Net Worth Individuals

Tax Strategies For High Income Earners The Trial Tax Return

Tax Reduction Strategies For High Income Earners Youtube

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes